|

Vous avez été cotisé… et voulez contester? |

|

Any transfer of assets involves liability for the beneficiary, whether a trust or a spouse. If a tax liability exists for a period during which a transfer occurred, whether the debt exists at the time of the transfer or not, this transfer entails the financial responsibility of the beneficiary. For example, if in 20XX you give your house to your spouse and 5 years later new assessments are issued for the 20XX period, your spouse will become jointly and severally liable for your tax liability up to the value of the debt or value of the house during the transfer. Asset protection can thus occur in two specific situations: in the absolute absence of present or potential debt and in the context of a present or potential debt situation. Before tax debts jeopardize your assets, they can be transferred in various ways that can be mounted by notaries, lawyers or other competent advisors. (Trust, estate freeze, spousal donations, etc.). Since these situations are not contentious, they are not part of our services offered. If tax debts exist or are likely to exist: Giving one's spouse's home after being assessed is unfortunately not an effective strategy under the circumstances, nor is the transfer of assets in a trust. Do not forget that in Quebec, trusts protecting assets are limited to very specific situations. If your professional suggests a trust to protect your assets or put your home on behalf of your wife while you already have significant tax debts, change your professional. Please note that liability for tax transfers and illegal bankruptcy transfers are unrelated. A bankruptcy transfer does not in any way limit the beneficiary's liability in tax matters. The release of a bankruptcy does not limit the liability of the beneficiaries either. To learn more, we suggest we meet to see what can be done under these circumstances. |

|

Litige fiscal, litige fiscal, litige fiscal, autorité des marchés financiers, AMF, MESS, cotisation, impôt, taxes, taxe carburant, sanction, délit initié, administrateur, fraude, fraude fiscale, avocat, avocat fiscaliste, avocat fiscal, avocat affaires, avocat commercial, avocat mba |

|

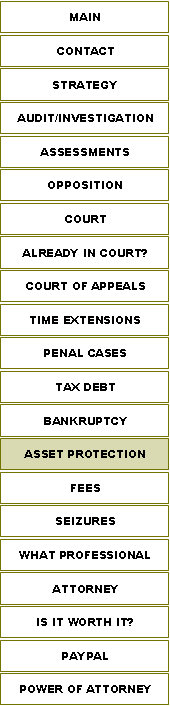

ASSET PROTECTION |

|

tel: 514-668-2265 |