|

Vous avez été cotisé… et voulez contester? |

|

Here is a general overview: Accountants: For bookkeeping, tax returns, accounting audits and preparation and / or certification of financial statements and for identifying tax strategies to minimize taxes owed. For assistance with a standard audit by the tax authorities. (See http://cpaquebec.ca/home.html) Notaries: Non-contentious issues (sales of real estate, business, estate planning, tax planning, trusts, etc.). It should be noted that several lawyers have a practice similar to notaries, as part of tax planning or sale of business for example. Notaries and lawyers have the same basic training. They are distinguished by their professional practice and belonging to distinct professional bodies. (See www.cnq.org ) Lawyers: Litigation, only professionals authorized to represent parties in litigation. Lawyers usually practice in specific areas of law since the laws are complex and the applicable procedures and timeframes vary widely between these areas. Examples of areas of law include criminal and prison law, general civil law, commercial law, family law, bankruptcy law, labor law, immigration, tax planning, tax litigation. Our practice is in tax litigation, tax related problems: taxes, withholding taxes, tobacco taxes, and so on. Tax litigation differs from tax planning in that tax planning aims to anticipate the future, protect assets and minimize future taxes in different ways. Tax litigation aims to dispute assessments of penal charges and to protect assets threatened by the tax debts or blocked in criminal situations. Trustees in bankruptcy: In addition to the possibility of avoiding the outright liquidation of assets through bids, the trustee in bankruptcy takes possession of the assets of the bankrupt and manages them with the objective of liquidating them and remitting the proceeds of the bankruptcy. He does not work under the direction of the bankrupt but under the supervision of a judge of the Superior Court. Bankruptcy means losing assets and waiving ongoing tax litigation, which is not without consequence and deserves serious consideration. (see http://www.ic.gc.ca/eic/site/bsf-osb.nsf/fra/accueil )

|

|

Litige fiscal, litige fiscal, litige fiscal, autorité des marchés financiers, AMF, MESS, cotisation, impôt, taxes, taxe carburant, sanction, délit initié, administrateur, fraude, fraude fiscale, avocat, avocat fiscaliste, avocat fiscal, avocat affaires, avocat commercial, avocat mba |

|

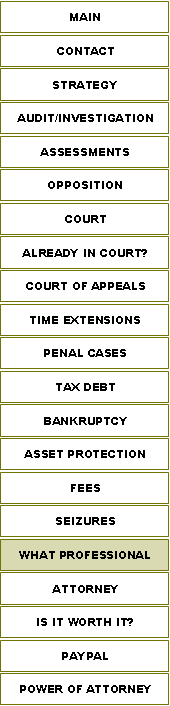

ATTORNEY, ACCOUNTANT, TRUSTEE? |

|

tel: 514-668-2265 |