|

Vous avez été cotisé… et voulez contester? |

|

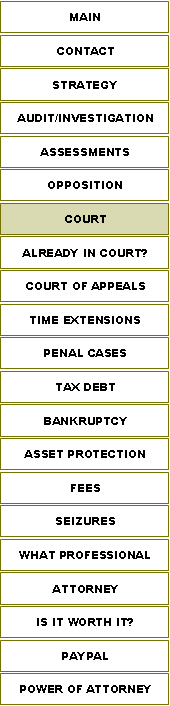

Our strategy is always the same: limit spending to procedures that maximize your chances of success and be straightfoward. You may expect to spend a fortune but you shouldn’t and there is abuse, let’s discuss it. First off, keep this in mind: an opposition is an administrative process whereby the tax authorities review the auditor's decisions without a neutral reviewer. Indeed, sometimes the same auditor who did your audit is the one who truly decides your opposition. Documents not previously considered during the audit will be considered in the context of the opposition, as well as obvious errors in the audit, like calculation errors. However, be warned that if you repeat the same arguments you raised during the audit, your chances of success are practically nil. It does not mean that your arguments are bad, but simply that the tax authorities generally support the findings of their auditors during the oppositions. Keep in mind that losing at the level of oppositions does not mean your grounds for opposition are without merit, they are just not yet reviewed by a neutral tribunal. Opposition officers do not consider testimony ou limitation periods applicable unlike a trial judge. Also, many « professionnals » don’t hold any profesionnal titles and only attorneys can go to Court. Title-less « professionnals » will sometimes charge fortunes for oppositions the say it’s pointless to file an appeal...because they can’t. Basic oppositions should not cost more than 1000$ and appeal are usually worth the cost. The appeal The appeal is made at the Court of Québec or in the Tax Court of Canada, depending on the type of assessment and who issues it. To be profitable, this appeal must result in a saving of fees, penalties and interests in excess of the costs of the appeal (court, bailiff, stenographer and lawyer fees). The analysis of your chances of success and the estimated costs of the whole appeal is done during a free meeting with us that lasts about 30 to 60 minutes. We will then explain the legal issues of the appeal. Tax authorities can afford any court costs, even if they seem abusive and unfounded. A good tax litigation strategy begins by minimizing the expenses needed for an effective challenge, avoiding procedures that do not really affect your chances of success. It is deplorable, but possible, to exhaust yourself or quickly run out of money if your attorneys are unreasonable. That the real debate will only take place in the weeks before a trial, sometimes several years after the start of the proceedings. |

|

Litige fiscal, litige fiscal, litige fiscal, autorité des marchés financiers, AMF, MESS, cotisation, impôt, taxes, taxe carburant, sanction, délit initié, administrateur, fraude, fraude fiscale, avocat, avocat fiscaliste, avocat fiscal, avocat affaires, avocat commercial, avocat mba |

|

GOING TO COURT |

|

tel: 514-668-2265 |